Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

European fintech Klarna has confirmed that it has raised $800 million at a fairly hefty valuation drop.

Rumors have been circulating for not less than the previous month that Sweden-based Klarna, finest generally known as a “purchase now, pay later” service supplier, was searching for to lift new funds. Preliminary experiences prompt this valuation can be within the area of $15 billion, representing a pointy decline on its $45.6 billion valuation precisely a 12 months in the past. Then earlier this month, leaks prompt that the valuation could also be nearer to $6.5 billion — and that, as issues have transpired, is just about the dimensions of it.

Klarna confirmed right this moment that it’s now valued at $6.7 billion off the again of its new funding, representing a 85% drop on the corresponding determine reported in June, 2021.

The spherical included a slew of recent and present buyers, together with Sequoia, Silver Lake, Commonwealth Financial institution of Australia, the UAE’s sovereign fund Mubadala Funding Firm, and Canada Pension Plan Funding Board (CPP Investments).

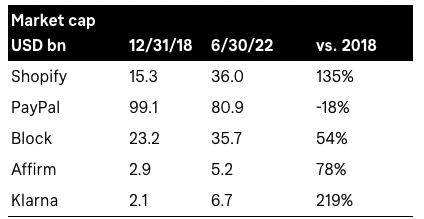

Eager to place one thing of a spin on the announcement, Klarna highlights the “worst inventory downturn in 50 years” in its personal press launch headline, whereas additional down it additionally tries to color a prettier image by exhibiting how its inventory right this moment seems to be in opposition to 2018 — and it makes use of well-known publicly-traded fintechs for comparability. It maybe is not any shock to be taught that Klarna seems to be fairly first rate with this hand-picked dataset.

Klarna’s valuation comparisons since 2018

The insinuation right here is that whereas Klarna’s valuation might have fallen off a cliff when taking a short-term view, it’s really performing not too badly on the grand scheme of issues.

Whereas many corporations have undergone one thing of a “correction” following pandemic-induced loopy instances, it’s value Klarna’s valuations from every of the years between 2018 and 2022 to get just a little extra perspective on issues. In 2019, Klarna was valued at $5.5 billion, adopted by $10.6 billion in 2020 and $31 billion in March 2021, earlier than hitting the giddy heights of $45.6 billion only a few months later.

So Klarna hasn’t simply dipped from its earlier valuation, it’s nonetheless markedly down on its valuation in 2020, and solely marginally up on its valuation from the 12 months earlier than that. However hey, in comparison with 2018, issues are nice.

That each one mentioned, there in all probability is one thing to Klarna’s spin. Its valuation is a mirrored image of what its buyers assume and doesn’t essentially mirror what clients assume, and it’s removed from the one firm to see such a downfall. Roughly a year-and-a-half on from its huge IPO, Klarna’s rival Affirm has additionally endured turbulent instances, with its shares plummeting over the previous 12 months — it too is now valued at roughly the identical quantity as Klarna, after its market cap peaked final 12 months at round $47 billion.

[ad_2]