Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

[ad_1]

This blog targets entrepreneurs in the FinTech industry who have a loan lending app development idea.

If we look at the alternative lending market that consists of different loan options apart from older bank loan options, the transactional value of the lending market is about to reach $344,421 million in 2022.

Now, this is a huge number and clearly shows the potential to invest in money lending app ideas.

In this blog, you will learn about

Having an app idea to build a customized money lending app solution is great, but before understanding how to create a mobile application, it is essential for you to know about the prerequisites to follow. The following list will help you to keep things in order.

| Prerequisites | Explanation |

|---|---|

| Business Registration Form | Choose how to register a legal entity. If you register your business as a corporation or LLC (limited liability company), you will protect your business against creditors in case of any force majeure or bankruptcy. |

| Register Your Business Entity | Pick a required service and enroll as an entrepreneur. Follow all the government requirements and register your business with a unique name. For example, if you want to establish your business in the USA, register it with uspto.gov. |

| Secure Initial Capital | You have three options to secure initial capital, we have explained it here.

|

You know the prerequisites to initiating your money lending business, next check the step-by-step procedure to build the money lending app.

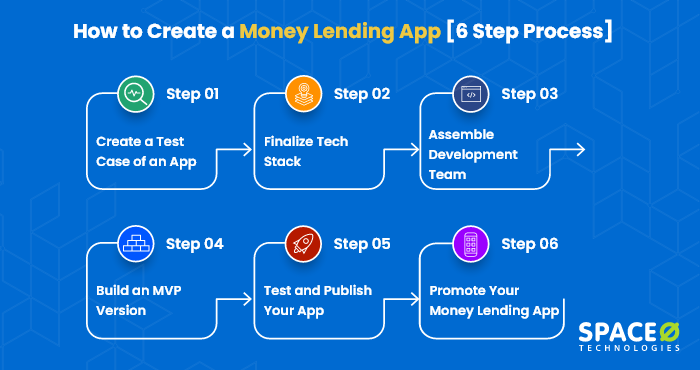

After taking these points into consideration, here are the 6 steps process of money lending app development you need to follow.

Having a money lending app idea is the first step to consider in the loan app development process. Next, you should have a team who is well versed in finance and understands all the laws of the region. After understanding all the rules and regulations, create a test case of your money lending app development idea consisting of 3 elements.

Along with keeping these 3 elements in mind, perform detailed market research about your money lending app. Here are the steps and an explanation to check successfully perform market research.

| Steps to follow | Explanation |

|---|---|

| Competitor Reviews |

|

| App Features |

|

| Analyze Business Listing Websites | Set the filter according to business categories, articles, and relevance. By doing this you will be able to know what your competitors are providing in their application and their monetization strategy. |

Another key element to remember is to build your loan app from a futuristic point of view. You need to think about the functionalities, technologies, and scalability. As the demands will increase in the future, you will be responsible for scaling your money lending app with the latest features and functionalities. Additionally, check different ideas to build a personal finance app successfully.

Want to Validate Your Money Lending App Idea?

Contact us. Book a free consultation with our experienced app development team to get valuable information.

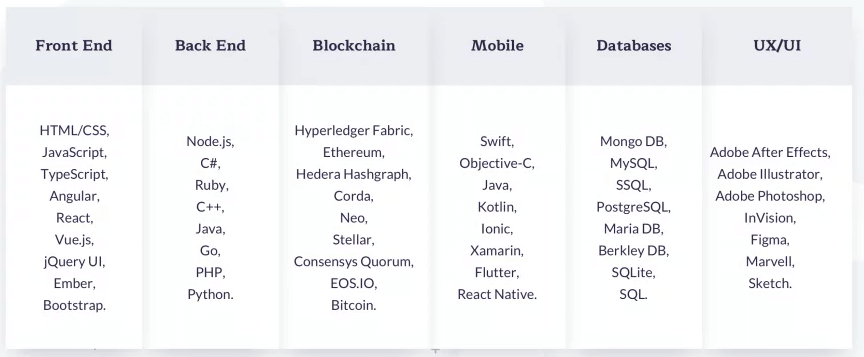

Choosing the right tech stack is important to build scalable money lending apps. As the technology is scaling fast, the entire app lending process has become simpler and more reliable than it was before.

The below image shows the list of technologies that are used for web and mobile app development. FinTech applications use these technologies to build their mobile applications. This tech stack is not limited to only building money lending apps but covers the entire FinTech industry.

Even using the latest technology stack, we have built 2 well-known FinTech apps for our client. Have a look.

FTCash

FTCash is a corporation that facilitates electronic payments and provides loans to small and micro-businesses. FTCash also received $140K in pre-series A fundraising from the IvyCamp platform on March 3, 2016, according to the Economic Times.

PayNow for Stripe is a simple point-of-sale tool that lets you accept credit card payments using Stripe right from your phone. The app has helped generate 35 times ROI, gain more than 50,000 users, and also ranked 3rd in the top innovative app category.

After successfully choosing the right tech stack, the next step is to form a team of experienced FinTech app developers.

To develop your money lending app successfully, hire a dedicated team, on-site team, or follow a fixed price model or hourly price model depending upon your project requirements.

However, it is best to assign the project to experienced companies with past experience in building FinTech related mobile app solutions. Therefore, the below entities are required to complete your money lending mobile app development project successfully.

Being a reputed mobile app development company, we have more than 200 experienced developers who have built more than 4400 mobile apps. The next step will be to build an MVP version of the app.

As Eric Ries, a well-known American entrepreneur quotes, “A minimal viable product is a version of a new product that allows a team to gather the most amount of validated customer learning with the least amount of effort.”

Begin preparing the MVP after you’ve chosen a team for your project. Product MVP is a must-have for anyone who wants to approach the creation of a new application with caution and logic. It helps you avoid a lot of mistakes and offers you an advantage over those who, in most situations, build the entire product right away.

In addition, people may not need some of the features that you planned to spend a lot of time and effort on. Ignoring those features will help you reduce cost and time and allow you to focus on what your audience needs the most. After the MVP development ends, the step will be to test and publish the application.

Your job doesn’t end after building the MVP version of the app. It is essential to test your mobile app strategically to ensure its superior quality output. Here are some of the test methods to follow.

| Elements to Test | Explanation |

|---|---|

| Automation | Automation integration is necessary to increase app efficiency. It also helps to increase product quality and decrease manual effort. |

| App Security | Personal data protection monitored compliance and high API security should be tested. |

| Data Integration |

|

| Functionality |

Functionalities should be tested using a regression testing method. Expected app functionalities such as account opening, bill payment, and deposits process should work seamlessly. |

| Performance Testing | While applying for loans, some instant loan apps crash; this is a sign of poor app testing. Your app should not crash even while having an increasing amount of user base. |

After successfully testing your mobile app, launch your app. Now, the question comes to how well you promote your application? What steps will you take to market your mobile app? To answer your questions, here are 3 ways to market your P2P money lending app.

Design a landing page with intuitive design and engaging content to drive maximum conversion for your lending app. Even a website is an essential tool for generating quality leads for your money lending app. Design a simple yet intuitive landing page to get maximum exposure from users.

To get inspiration, check the websites of leading money lending businesses in the USA, such as Earning and Dave.

There are 3.78 billion social network users across the world. Moreover, 65.3% of Americans are about to use digital banking by the year 2022. Facebook, LinkedIn, and YouTube consist of a higher user base, where you can promote your money lending app.

In a poll of worldwide marketers performed in mid-2019, 91% of respondents stated that content marketing was already being used as part of their promotional activities. For example, blog post creation, video marketing, eBook writing are some ways to promote your brand as well as your app to the end-user.

Your end goal should be to monetize your money lending app successfully. By having enough finance, you will be able to scale your business.

We discussed how to create a money lending mobile app, next, you will learn about legal compliance and encryption-related points.

If you have decided to go fully-fledged with your loan apps business idea, you should take some precautions to avoid fines and penalties. Even it is essential for you to protect your app from malefactors. So by applying the following points, you can easily protect your app from hacking, data breach and secure your mobile app.

| Compliance and Encryption Points | Explanation |

|---|---|

| Seamless Working of App | Developers need to consider P2P lending apps to be fault-tolerant. It will work uninterruptedly even if a heavy load due to a large number of simultaneous operations may occur. Therefore, it is required for a developer to use tools that will handle fault tolerance. |

| Prioritize Security | Integrate biometric authentication and two-factor authentication. Apart from that, make use of APIs to safeguard user data. To keep your app safe from fraudulent actions and cybercrime the connection from the P2P platform to servers should be encrypted. |

| GDPR Compliance | If you are launching loan apps in the EU (European Union) market, making a GDPR compliant app is crucial. This regulation became officially effective on May 25, 2018. If you don’t want to be fined, you should follow these steps to make the lending process seamless. |

| CCPA Compliance | The aim of the California Consumer Privacy Act (CCPA) is to secure users’ private data for California residents. It is necessary for the users to have total authority over their personal data. CCPA became official on Jan 1, 2020. Therefore, if California is your target market, it is essential to make your mobile loan app CCPA compliant. |

After understanding legal compliance and encryption methods, the next step is to know about the development cost of the money lending app.

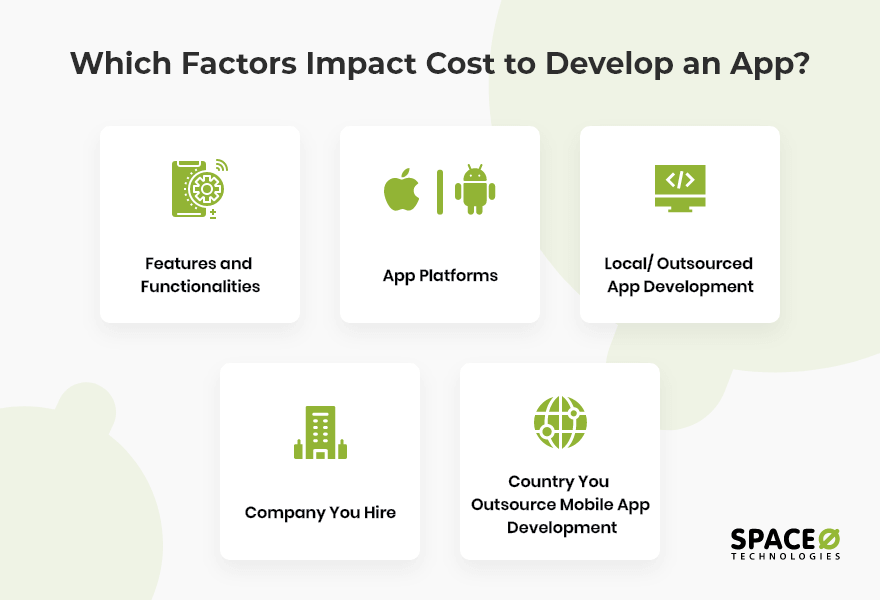

The cost to build a money lending app may range between $25,000 to more than $1,00,000 depending upon factors such as app functionalities and features. To know more, check the below image that mentions the factors directly impacting the app development cost.

After discussing the cost, next we have curated an estimated timeline to build a money lending app.

| Money Lending App Development Process | Estimated Man Hours | |

|---|---|---|

| iOS | Android | |

| Wireframing | 40 hours | 40 hours |

| Design | 45 hours | 45 hours |

| SRS | 35 hours | 35 hours |

| Test Case | 30 hours | 30 hours |

| App Development | 220 hours | 220 hours |

| Backend Development | 160 hours | 160 hours |

| App Testing | 40 Hours | 40 Hours |

| Total Hours | 570 Hours | 570 Hours |

This isn’t the end of the schedule for money lending app development. We’ve also provided a rough timeline based on the many sorts of educational apps.

| Top Features of Money Lending App | Estimated Man Hours | |

|---|---|---|

| iOS | Android | |

| Loan Management | 52+ Hours | 52+ Hours |

| Payment and Billing | 40+ Hours | 40+ Hours |

| EMIs and Transactions | 52+ Hours | 52+ Hours |

| Withdrawals and Transfer | 170+ Hours | 170+ Hours |

Want to Develop Customised Money Lending App Solution?

Talk to us. Share your P2P money lending app idea with our app consultant and our experienced team will help you to build a customized solution.

According to Statista, 31% of users expect to have an option to take and submit pictures of key documents while processing the loan documents. Apart from this feature, here are the 7 money lending app features you must integrate while developing your application. In addition, the table contains advanced features and its explanation.

| Advanced Features | Explanation |

|---|---|

| CIBIL Analysis | To apply for personal loans or business loans, you require a CIBIL score to at least go closer to 900 points. The closer your score is to 900, the higher your chances of getting approval to take loans. |

| Dynamic Requirement Gathering | Your loan app must be able to generate document requirements after examining loan characteristics dynamically. This will simplify the loan application and approval process. As a result, it will save you time and energy while allowing you to complete the process quickly. |

| Chatbot Integration | This feature will allow borrowers and lenders to communicate through in-app messaging without exchanging contact information. |

| Restructuring of Loan | PayPal and other mobile payments – this way, users will have different options to choose how they want to pay their loan or interest. |

| Payment System Integration | Your application must integrate with different payment methods such as PayPal, bank debit, and credit cards. This way, users will have more flexibility to pay as per their choice. |

| Reward Points and Ratings | If borrowers and lenders pay the amount with interest rates on time, they will be awarded additional points. Thus, it will make your app reliable for the end-user and increase trustability as well. |

| AI-based Analytics | Users and admin will benefit from real-time analytics. In addition, the admin will have the right to check platform operation using AI and big data technologies. |

We have discussed advanced features, next check the top examples of loan lending mobile apps.

We have listed the money lending mobile apps you should take inspiration from. If you are searching for more ideas, check the list of best FinTech apps to get some inspiration.

We have discussed the best examples of money lending app, next read the FAQs people ask prior to developing money lending app.

To make your lending development project cost-efficient, you should choose the right development model for your project. The below table illustrates 2 types of models and their explanations.

| Development Type | Explanation |

|---|---|

| Hire Product Development Team | When you have the idea and the funds but not the team to develop it into a real product, this is a great option. When it comes to product creation, the technology partner you hire must be able to handle the entire process, from concept to design, coding, release, and continuing product support. |

| Hire a Dedicated Team | Sometimes you have the in-house experience to start developing an app, but you can’t scale quickly enough or find the specialists you need to keep the project moving forward under tight deadlines. This is why employing a specialized team is the most effective approach for immediate access to the required skills and ensuring that software development and scaling follow the approved roadmap. |

Basically, users who require to borrow money need to follow the below-mentioned procedure to make the app work.

As soon as the procedure completes, you will receive an email and text message of the amount and interest rate you have been granted a loan.

Build your loan app in the native. Because you will get exceptional performance, security, as well as your app will work seamlessly, which will give a feel that your app is an inbuilt part of your mobile.

We have covered prerequisites, answered the question of how to build a money lending mobile app, and discussed legal, and compliance as well. Apart from that, you have obtained an answer to the frequently asked question of how much does it cost to develop a loan app cost, features, examples. Also, FAQs are included in this blog to help you to understand in-depth information about the money lending app.

Building a money lending app development process is cumbersome. However, by following this guide, you will surely be able to succeed in building a customized money borrowing app for your FinTech startup.

Being a well-known mobile app development company for the past 11 years, we have experience developing customized money lending mobile apps.

Book a consultation with one of our tech consultants and validate your idea to succeed at your business.

[ad_2]